Something I have learned I’ve learned over the years is that everybody budgets differently. One trick I do is to hide money from ourselves. I set up “fake” accounts and put money in them to go towards things like car insurance, Christmas shopping, etc. It is a way for me to save for the things we need to. That being said, it is a terrible way to budget. Bill never has any idea how much money we have since the account balance the bank gives him never matches mine (due to these “fake” accounts).

Something I have learned I’ve learned over the years is that everybody budgets differently. One trick I do is to hide money from ourselves. I set up “fake” accounts and put money in them to go towards things like car insurance, Christmas shopping, etc. It is a way for me to save for the things we need to. That being said, it is a terrible way to budget. Bill never has any idea how much money we have since the account balance the bank gives him never matches mine (due to these “fake” accounts).

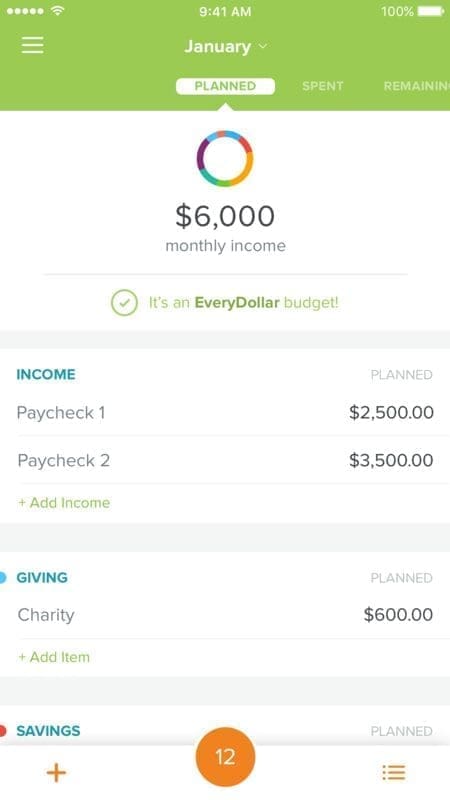

That is where EveryDollar comes to the rescue. EveryDollar truly makes budgeting easy. It takes less than 10 minutes to create your first budget. I personally love things that are just pick up and use. There’s nothing worse that using a program that it take a class to learn how to use it. I love how I can create a budget using every single dollar. I expecially love that you can connect multiple device. Bill works crazy hours and having him be able to see how our accounts look without calling me is pretty amazing. He can see if he can take money out and knows what’s in our vacation fund without me having to stop what I’m doing to check for him. The EveryDollar PLUS feature allows you to pay a yearly fee to connect your bank accounts and see budgeting in real time. You can also see visually where your money is going. Sometimes, we don’t realize we are spending too much on things like eating out.

Who wouldn’t want to be able to manage their money while they are on the go? We just got done saving for our Disney vacation (that’s where I am right now!), and this would have been so much easier to use! What are you saving for right now that EveryDollar could help you budget for?

EveryDollar looks like a great tool! I will check it out.

I am always looking for great budgeting sites and this one looks great! I love the detail and knowing where every dollar goes!

I love the everydollar app. It’s such a neasy to keep track of our budget. I love that the app makes it easy to enter expenses and income.

Budgeting always scares me for some reason. This doesn’t look too bad. I can’t wait to check it out.

This sounds like such a helpful app. Saving up can be so difficult when there are places like Target, don’t you think? I am saving up for a vacation to go and relax on the beach!

Right now things are tight for me to save anything. I am in the process of moving in to a new apartment and don’t have anything extra to spend or save. I would eventually love to start saving for a new car. Thanks for sharing this awesome savings tool.

Wow! That looks like an awesome way to pull a budget together.

I try to keep some money separate, but will admit that fund often gets tapped for emergencies.

I am saving for retirement. It is something me and my husband have been doing for years now. We do not want to be a burden to our children so saving for future medical expenses, housing, utilities, etc. is our top priority. I will have to check out this app you featured. May work better than keeping a ledger.

Currently, I’m saving for my half towards my daughter’s first car we are buying her this summer, if she passes her drivers test! Also saving for a long weekend vacation to Tennessee this summer 🙂 I try to budget, but it never goes the way I want it to!

I could really use something like this to keep my budget on track. Heck, I don’t even have a budget to be honest. I need to set one up so we can get on track here. This app could help me with that.

EveryDollar is a great way to set and keep a budget! I have been hearing nothing but great things about it lately.

We paid off our smallest bills first and put the money toward the next smallest bill and so forth. This really worked for us.

I started doing that “fake money account” last year and it continues this year. It is for future and unknown expenses that we will incur.

EveryDollar is a great app. I heard about it a few weeks ago and immediately started using it. It’s been a HUGE help to my budgeting.

It’s nice that there’s everydollar to help you on your budget. I try to set up saving accounts (passbook accounts), which I can only access in the bank and not via cards. Going to the back takes time than just withdrawing via ATM card so I just get to access my funds only when needed.

This looks like a great resource. I have never seen this before but am always looking for ways to better manage this. Thanks!

We always save for our annual 3-week summer vacation. It’s always nice to have the money saved up and not have to touch our bank account when we’re vacationing.

right now we are saving for our annual trip to Disney World. Our tax refund is definitely going to help!